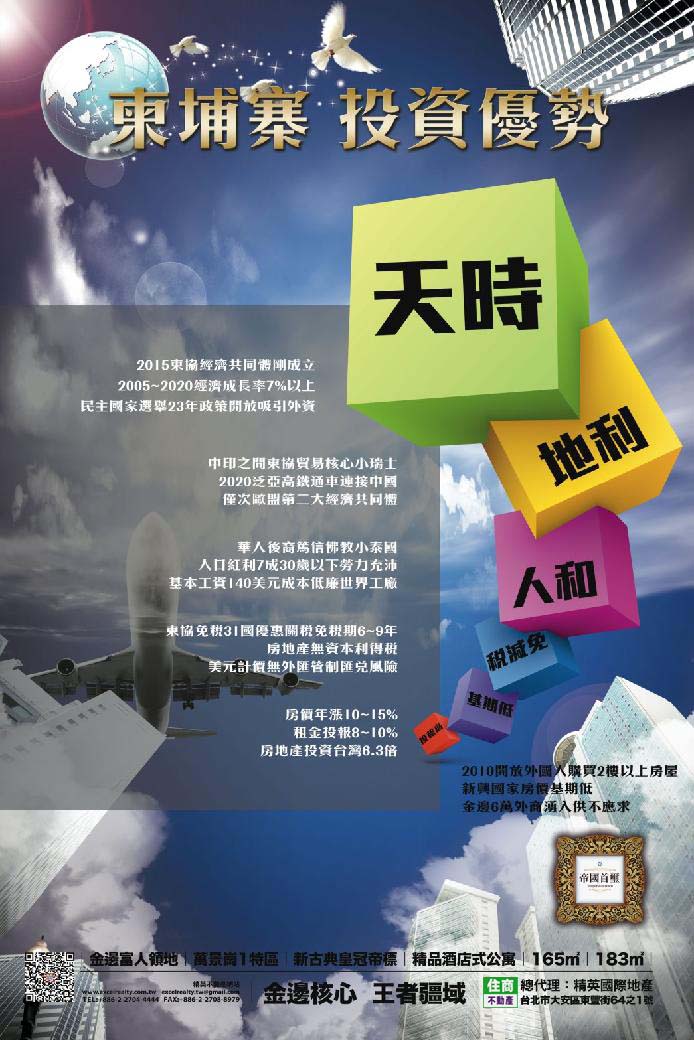

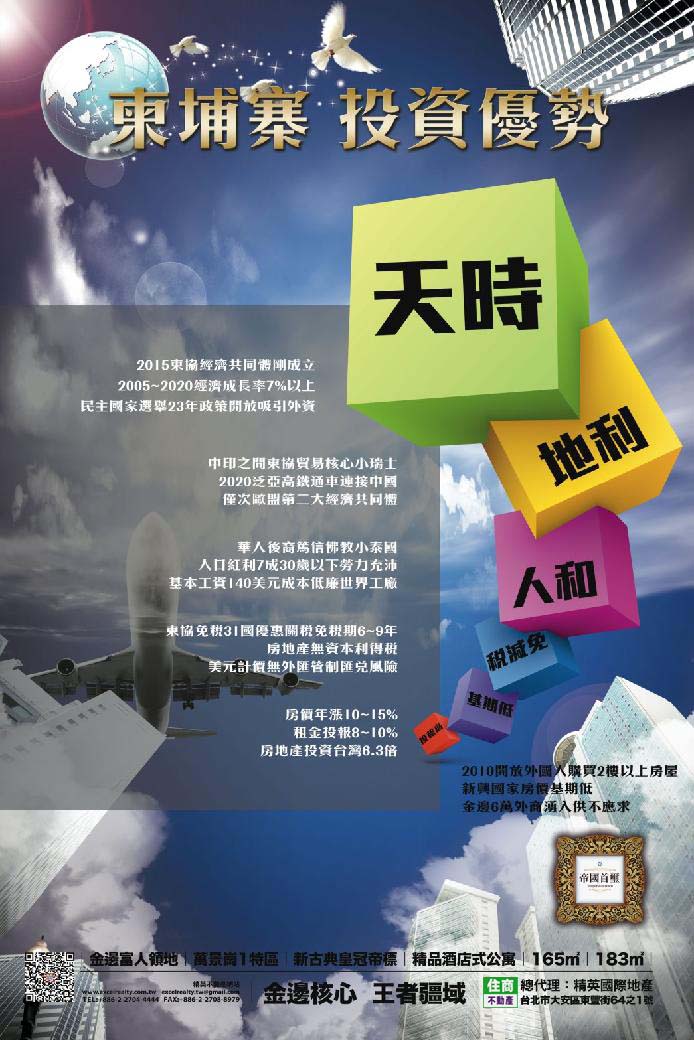

ASEAN is the first choice for overseas investment ASEAN is the first choice for Phnom Penh

redistribution of wealth

Choice is more important than hard work

Carefully selected comparison

Weed out the weak and keep the strong

Investment and financial management tools

Preferred Real Estate>Stocks, Funds, Gold, Fixed Deposit...

The key to investment and financial judgment

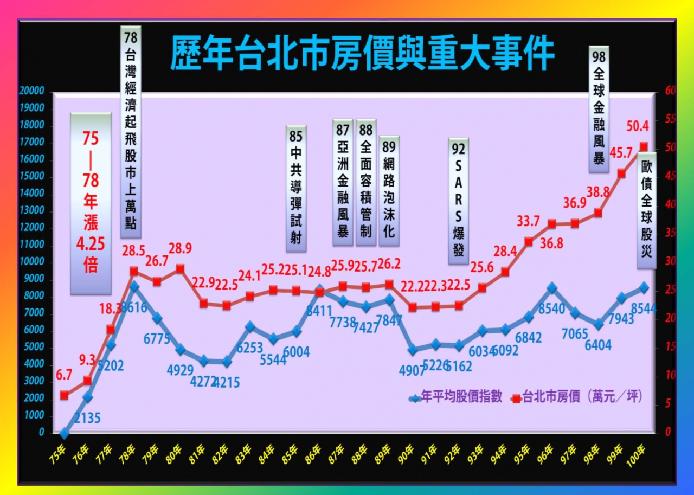

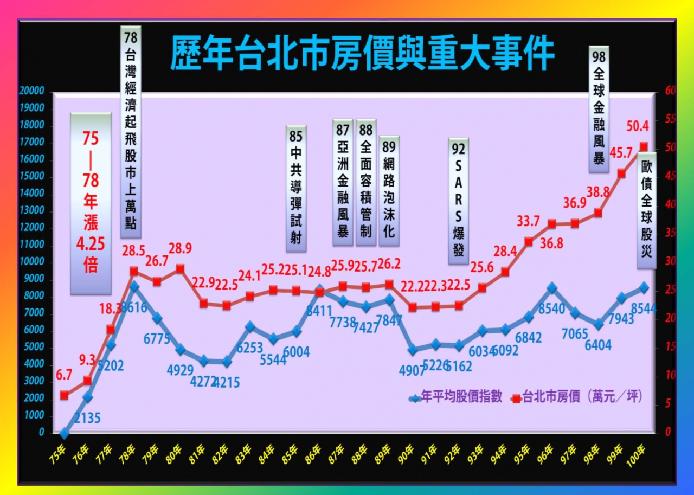

Primary Indicator Volume Price Relationship

Increase in volume and price ⇒ Market prosperity ⇒ Time to enter the market (such as the Phnom Penh housing market / model rising)

Volume shrinkage and price drop ⇒ market depression ⇒ time to exit (such as L-shaped recession in Taiwan’s housing market)

Volume price divergence ⇒ market reversal ⇒ observation timing (To Be or Not To Be?)

Never choose the wrong side again

Treat the initial stage as the final stage

prosperity as recession

recession as prosperity

Mature market with low risk and low profit

Emerging Markets High Risk High Profit

Emerging market base period is low

So there is a lot of room for growth

The real estate market in Phnom Penh is about 6.8 times that of Taipei

Strict selection of asset management, elimination of the weak and retention of the strong

Phnom Penh housing market = Taiwan 30 years ago = China 20 years ago

Go back in time, go back in time, see the future

The real estate industry depends on the sky

Keep up with the government's southbound policy

Guiding the future direction of Taiwan's outlet

Expand Taiwan's domestic demand and ASEAN investment opportunities

Character Jinliu goes south to the ASEAN to play in the Asian Cup

Investing requires wisdom and courage

Money is hard to buy, I knew it earlier

Copying Taiwan's experience

Please seize the rare opportunity

your real estate life

can do it again |