※National policy:

Open the market and implement a free economy |

※The first year of ASEAN in 2015

The rise of ASEAN and the economic take-off |

| ※The national economic policy is open and welcomes foreign investment |

※Economic take-off drives the locomotive industry:

real estate, construction |

| ※The country with the most liberal and open economic policies in Southeast Asia |

※The base period of housing prices is low, and there is a lot of room for value-added growth |

| ※The freest foreign investment policy in Asia |

※More than 50,000 to 60,000 foreign businessmen in Phnom Penh,Fewer than 400 rental apartments |

| ※Open to foreign investment and fully develop the economy |

※The influx of foreign businessmen into the leasing market is in short supply |

| ※There are almost no restrictions on foreign investment industries |

※Phnom Penh's residential demand is about 200,000 units per year,The demand is increasing by about 10,000 units per year |

| ※Foreign investment FDI annual growth rate of 90% |

※The occupancy rate of houses in Phnom Penh is about 80~95% |

| ※The tax exemption period for foreign investment is 6~9 years |

※Rent reporting 8~10% per year |

| ※Tax exemption for importing raw materials and equipment with foreign investment |

※House prices increase by 10~15% per year↑ (Number 973 of this weekly magazine) |

| ※Foreign investment can hold 100% of the shares |

※No capital gains tax, no luxury tax |

| ※The most conservative banking industry in Taiwan has 7 banks stationed in it |

※No foreign exchange control |

※Yiyin, Zhaofeng, Heku, Yushan, Cathay Pacific,

Shanghai, Taiwan Enterprise Bank (micro financial institutions) |

※The only USD denominated in ASEAN

Strong currency without foreign exchange risk |

| ※General bank loan interest rate is about 9~10% |

※The core position of trade in the Golden Corridor of ASEAN, Little Switzerland

No Earthquake Typhoon French Colonial Phnom Penh Orient Paris |

※U.S. dollar one-year term at Yushan Bank

Fixed deposit interest rate 4.98% |

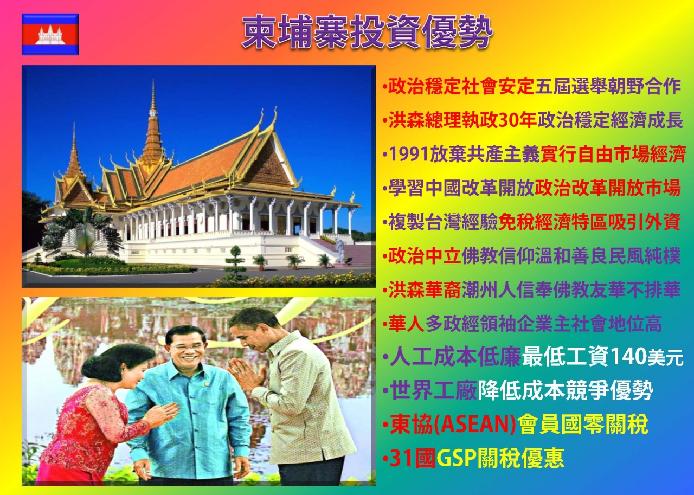

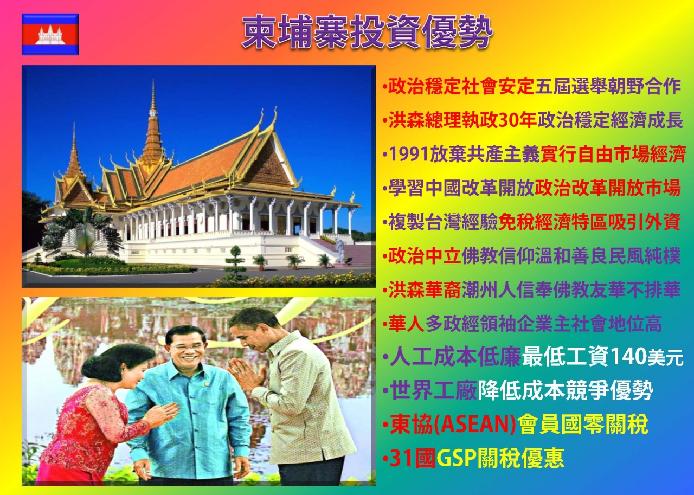

※Political stability and social stability

five parliamentary elections |

| ※The labor cost is low and the minimum wage is 140 US dollars |

※Prime Minister Hun Sen has been in power for nearly 30 years,political stability, economic growth |

| ※The demographic dividend is 70% younger than 30 years old |

※1991 Abandoning Communism

implement an open free market economy |

※Cheap labor and abundant manpower

low cost competitive advantage |

※Learning from China's reform and opening up:

Manpower→Technology→Management→Fund Intensive |

| ※The world factory with low labor cost |

※The world's 35th with the highest degree of economic freedom |

| ※ASEAN member countries have zero tariffs |

※The economic growth rate of GDP is more than 7% per year |

| ※WTO member countries enjoy preferential tariffs |

※One of the fastest growing countries in the world |

| ※GSP tariff preference for 31 countries |

※Industrial start-up market demand

Raw materials for daily necessities rely on imports |

| ※ASEAN 10 countries have a population of more than 600 million |

※Angkor Wat, the Seven Wonders of the World

Attract 5 million tourists a year and the tourism industry is developed |

| ※The second largest economy in the world after the European Union |

※Phnom Penh Land Price Survey 2014~2015 by British Knight Frank,An increase of more than 20% ranked first in ASEAN (Communication Magazine 582) |

※Pan-Asia high-speed rail opened to traffic in 2020

Reduce ASEAN transportation costs |

※In 2014 Q3, the land price in Phnom Penh business district increased by 20% year-on-year

Residential areas increased by 30% year-on-year |

※Pan-Asia high-speed rail connects China and Southeast Asia markets

Kunming, China⇔Singapore forms an 11-hour day-to-day living circle |

※2014 house price growth:

Phnom Penh 17%> Kuala Lumpur 9%> Bangkok 4%> Taipei 2% |

| ※China's first Pan-Asian International Expressway |

※2015 British Knight Frank survey of major cities in Asia

Residential land in Phnom Penh rose 26.2% to rank first in Asia |

※Prime Minister Hun Sen is a Chaozhou native of Chinese descent

Believe in Buddhism, Friendship with China, not exclusion of China |

※The country with the most investment in Cambodian real estate:

1. Korea 2. China 3. Singapore 4. Japan 5. Thailand |

※Business owners with multiple Chinese political and economic leaders

high social status |

※Real estate investment follows:

Government policy, economic investment, transportation construction |

※Buddhist belief is mild and kind, folk customs are simple

Geographical Environment Religious Culture Cuisine Little Thailand |

※ Southbound instead of Westbound Bye bye China!

Goodbye Taiwan! Hello Cambodia! |

※In 2010, foreigners were allowed to buy houses

You can buy a house with a passport above 2 floors |

※Taiwan's 15 largest trading partners ASEAN countries account for six |

※UK Global Property Guide Evaluation

Quite worth investing in |

※ASEAN’s economic growth rate is higher than that of the United States, and its population is larger than that of the European Union |

| ※Buy Cambodia and save US dollars, no foreign exchange risk |

※The region with the best chance of success in the next generation

Not Europe, America and China, but ASEAN |

| ※No land zoning control, no floor area ratio limit |

※Obama and Xi Jinping visited successively

Belt and Road AIIB targets ASEAN |

※Cambodia’s population rejuvenation VS

Taiwan's aging population |

※Cambodia = Taiwan 30 years ago, China 20 years ago |

※Cambodia's real estate market is going uphill VS

Taiwan's housing market in decline |

※History will repeat itself, change the stage and copy Taiwan's experience |

※Cambodia housing price rise VS

Taiwan housing prices fall |

※Wealth redistribution, choice is more important than hard work |

※Cambodia light tax open to buy a house VS

Taiwan's heavy tax crack down on real estate |

※Gold is hard to buy, I knew it earlier

Real estate life can do it again |

※Cambodia housing market volume increase price increase expansion period VS

Taiwan's real estate market shrinks in volume and falls in recession |

※Construction business one-stop service property management

Rental Charter Guarantee 18% for 3 years |

※Buying cheap in Cambodia VS

Sell high in Taiwan |

※According to 1. China’s reform and opening up 2. Taiwan’s economic miracle experience

3. Economic development of Cambodia in the past 10 years 4. Views of Cambodia's real estate industry:

As long as political stability and economic growth

In the next 5-10 years, Phnom Penh house prices will increase by 10-15% per year |

※The world's second tallest 133-storey Gemini Tower

World Trade Center started in 2016 and completed in 2019 |

※Phnom Penh house price rising trend: (2015@庆30万)

Annual increase of 10~15% will be @ping 48~600,000 in 2020 |

| ※The investment in Phnom Penh real estate investment is about 6 times that inTaipei |

※"Phnom Penh Urban Planning from 2015 to 2035"

1. In 2020, the urban area will reach 375km2, with a population of 2.5 million.

2. In 2035, the urban area is 675km2, with a population of 5 million, doubling the area and population |

※Three lows and one high investment in Cambodia:

Low unit price, low total price, low base period, high reward |

※After the 2018 general election, housing prices in Phnom Penh will continue to be high

Phnom Penh housing prices continue to rise due to demographic and quantitative factors |

※Four major benefits of investing in Cambodia=

House price + rent + interest + no foreign exchange loss for depositing US dollars |

※In 2020, the population will be 2.5 million, and the demand for housing will increase by 500,000. For example, 20% of urban white

For the collar class, there will be an increase of 100,000 in demand for mid-to-high-end residences.

From 2020 to 2035, housing prices in core areas will rise sharply, and mid-to-high-end commercial

Housing and apartment buildings will show value |